Minimizing Impairment Risk with a real Fintech service and Crossflow InvoiceProtect™

Crossflow has been rated by the Financial Times in 2021 as Europe’s fastest growing B2B fintech provider, and through its InvoiceProtect™ service minimizes fraud risk for funders.

Fintech has brought a wide range of benefits for the economy. The market grew by 30% in 2020 alone to over $1.3 Trillion dollars evidencing its importance in funding corporates and suppliers worldwide.

However, there is also a darker side of the picture, with recent events exposing risks which can cumulatively result in significant financial losses for Funders and other counterparties.

Many of these risks and losses have their origin in the need of Fintechs with high operating costs resulting in practices, which obscure counter party risk to maximize yield and also reduce visibility of subsequent transactions.

In context, sophisticated risks can be created and multiplied with a single corporate which emphasizes the importance of diligence and joined up processes right from onboarding corporates and suppliers, through KYC, verification of bank accounts, and indeed verifying a transaction history before funding that supplier even commences.

On an ongoing basis, a lack of transparency in transaction processing has always been a serious concern for the funders of such transactions. For example, the lack of a 100% match between invoices and payments should be a red flag for any Fintech and its funders as it is an early indication of fraud or cash manipulation. In summary, all invoices should always have a corresponding payment.

The Crossflow service has been developed to ensure resilience and confidence in funding to protect funders and other parties of the service from potential fraud by operating with complete transparency and security around the data and funding of transactions.

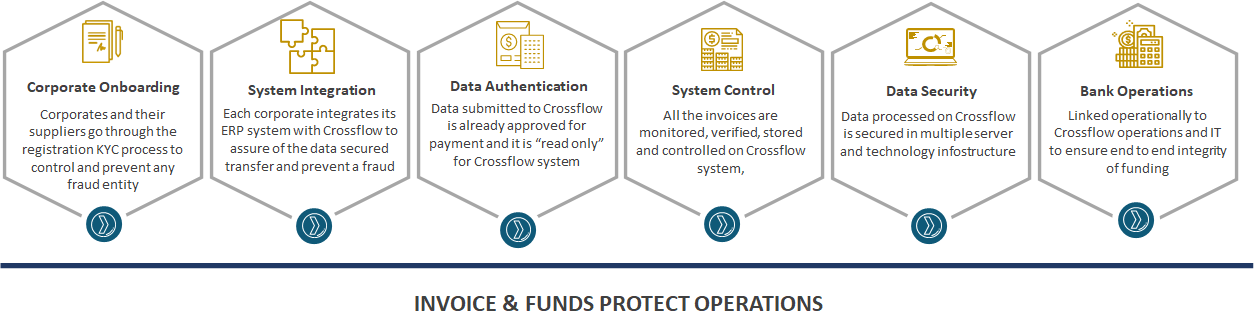

That technology and processes created by Crossflow are now registered under the trademark InvoiceProtect™ summarized below, which describe operations in the protection of electronic data, transaction valuation, and authentication. It provides data security to users while it passes through different IT systems and doesn’t allow system truncations or suchlike making any changes to the counterparty data and the values of the finance document records. This minimizes the likelihood of fraud between the parties exchanging the data. Also, the platform provides alerts against all potentially fraudulent transactions with AI backed technology making Crossflow the leading Fintech in protecting funders.

Please contact us for further information or discussion:

Magda Rozczka is COO at Crossflow. After completing her postgraduate MBA, Magda led product development within the insurance sector at ING and Zurich. Magda represents Crossflow on the Bank of England decision maker panel, which influences UK interest rates, and has represented Crossflow as part of HM Treasury’s Women in Finance initiative.

Magda Rozczka is COO at Crossflow. After completing her postgraduate MBA, Magda led product development within the insurance sector at ING and Zurich. Magda represents Crossflow on the Bank of England decision maker panel, which influences UK interest rates, and has represented Crossflow as part of HM Treasury’s Women in Finance initiative.