With the opportunity for significant working capital and margin gains, Crossflows AI driven working capital platform is becoming a key part of corporates toolkits.

CASE STUDY SNAPSHOT

As an example, a single corporate with COGS of £1.2Bn generated an additional £103m of working capital and a 4% improvement in COGS margin, through the efficiency enabled by Crossflows AI driven working capital platform.

FINANCIAL BENEFITS

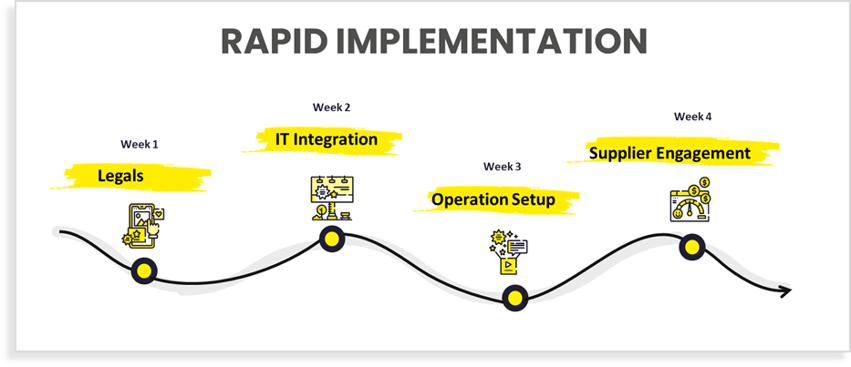

RAPID IMPLEMENTATION

A typical service implementation, enabling these gains for corporates and their supply chains can be completed in as little as 4 weeks.

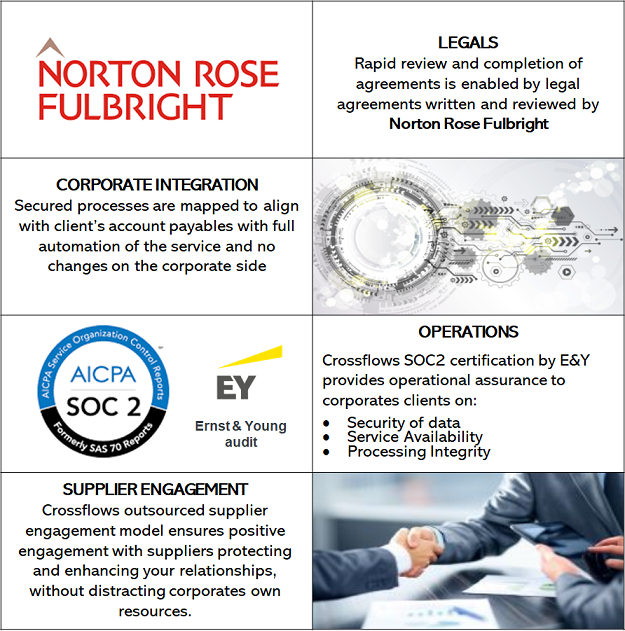

QUALITY IMPLEMENTATION FRAMEWORK

This accelerated implementation cycle is supported by four strong fundamentals as follows:

Here at Crossflow, we collaborate with the world's largest financial institutions enabling access to funding, and in turn we work with our corporate clients to increase the robustness of their supply chains by harnessing that working capital through our working capital marketplace.

It would be great to hear your thoughts and please message the team at Crossflow if you would like to discuss how we are working with our corporates on securing their suppliers by some of the world's largest financial institutions.

Tony Duggan- Tony is one of the founders of Crossflow. He served as Supply Chain Director at Wickes and B&Q prior to serving as Product Development Director at SWIFT, the global banking network. He also managed an outsourced fintech development project for HSBC in Hong Kong.